| 08/20/2014 What everyone should know about Medicare, Life Insurance, Retirement Planning and Long term Care Today we have our guest agent/consultant Ernest Badalov.

Ernest, you offer such a wide range of services that is not easy to define. Many of the programs that you work with are complex and unique. If you don’t mind, I’d like to break our interview today into four main sections: Medicare, Life Insurance, Retirement Planning and Long-Term Care. Let's start with the Medicare, what can you tell us about this type of insurance?

- Medicare is a national social insurance program that guarantees access to health insurance for Americans aged 65 and older who have worked and paid into the system, and younger people with disabilities as well as people with end stage renal disease and persons with amyotrophic lateral sclerosis. - Medicare is a national social insurance program that guarantees access to health insurance for Americans aged 65 and older who have worked and paid into the system, and younger people with disabilities as well as people with end stage renal disease and persons with amyotrophic lateral sclerosis.

Medicare has three main parts:

* Part A is Hospital Insurance, including Skilled Nursing Care

* Part B is Medical Insurance, including physicians and specialists

* Part D covers various prescription drugs. There are 34 existing plans offered by different companies in the states of MD, VA and DC. For those who have a low income, the state helps to cover up to $ 40 per month to pay for the prescription drug plan. I help my clients select the best plan available for them based on their medications.

Does Medicare Part B fully cover a person’s medical expenses?

- No, it only covers 80%, in addition to it, the purchase of additional insurance (Medicare Supplement or Medicare Advantage) is also highly recommended. It is imperative to know that only within 6 months (3 months before the age of 65 and 3 months after) you can apply for guaranteed supplemental coverage, regardless of your pre-existing health conditions.

Ernest, where people can get information and clarification on this program?

- The Manual on Medicare by Social Security consists of a couple of hundred pages and it is not easy to understand. Most of the information provided for reference, is not applicable in all situations. To help understand the ocean of information and to find what is right for you, I provide complementary individual counseling for clients at their homes or in the office. I not only explain and help to choose the appropriate plan for them but also engage in servicing my clients throughout their coverage. Information on Medicare, supplemental and drug prescription plans are constantly being updated. I work very close with my clients, informing them about the emerging changes and my clients can call me anytime if they are facing any problems.

What states do you work in?

- I am licensed in Maryland, Virginia and the District of Columbia (MD, VA, DC). - I am licensed in Maryland, Virginia and the District of Columbia (MD, VA, DC).

How can you be reached?

- By telephone +1 443-527-8975, or by email: myretirementcare@gmail.com

Thank you Ernest, let's now talk about life insurance. What can you tell us about this type of coverage?

- Unfortunately, the majority of people do not fully understand the value of such coverage as Life Insurance or treat it with a grain of salt. Such type of insurance has a variety of different purposes, ranging from ten to fifteen thousand dollars to cover funeral expenses or leaving a legacy for children and grandchildren. We all know that we will not last forever, and that it is only a matter of time. Leaving a legacy of a half a million dollars or more, can change their children and grandchildren lives forever.

Can you please give us an example?

- Of course, here’s just one example; A typical family of four (father, mother, and two children). The family buys a house that’s worth $300,000 to be pain in 30 years. Suppose dad’s salary is $80,000 a year, and mom’s - $60,000 a year. They have enough money to cover their mortgage and other expenses. Let’s say by coincidence, one of the parents dies, you know life is unpredictable. What should the other parent and the children do? Lose the house? Look for a second job? This can be avoided. Life insurance will compensate the family for the amount of debt for the house and other expenses. By the way, such insurance, for example, in the amount of $500,000 for a man age 40 costs $ 42.44 per month, and for a woman age 40 - $ 35.00, for 20-year coverage.

Many employers provide life insurance coverage at work. How do they differ?

- This is a temporary group coverage that expires from the moment you leave your employer. My insurance coverage options work as an investment tool, in some sense, that are not taxed upon its payment. There are dozens of possible coverage scenarios; they all are discussed during a meeting with a client.

Can you give us a more precise example with numbers?

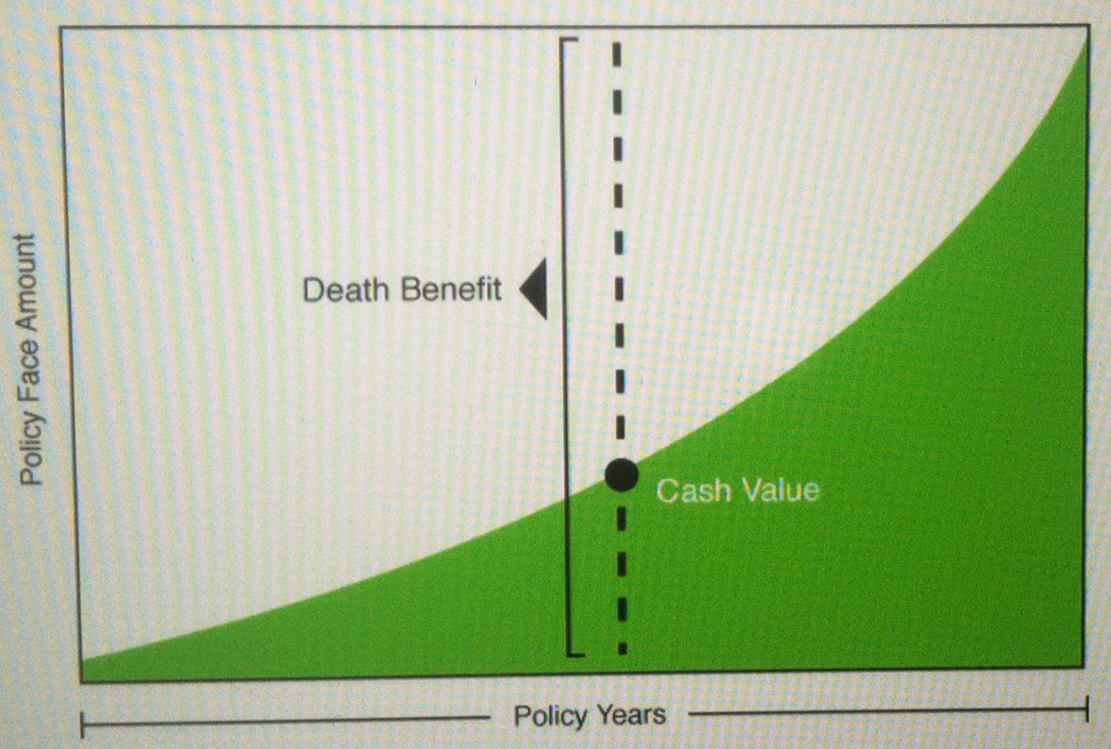

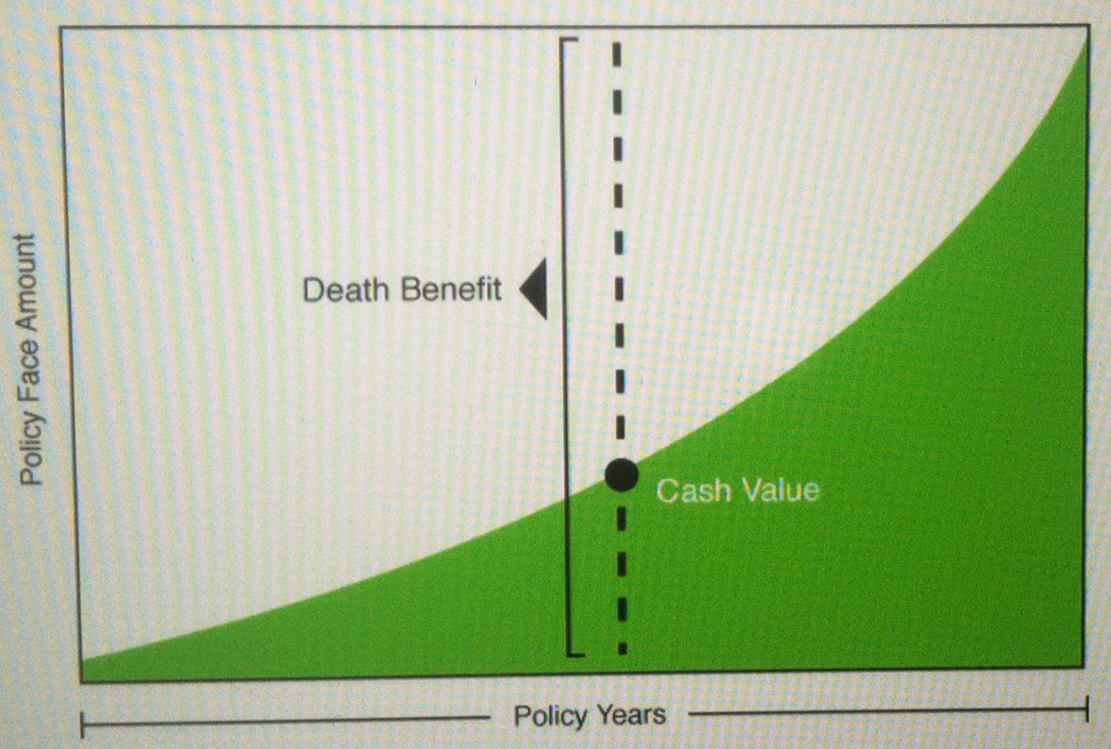

- No problem. Let’s take a family where a woman is in good health and is 30 years old and her child is 5 years old. Mom buys a life insurance with an “increasing death benefit" option for $ 100 per month in premium with an initial $ 150,849.00 death benefit. In 10 years, the death benefit amount rises to $ 161,454.00 with the same $100 a month premium. In 20 years it worth $ 186,00.00. At the age of 85 years (the average life expectancy in the United States), the insurance amount consists of $ 602,894.00 in coverage. This is the amount that will be inherited by her children or grandchildren in the future. For 50 years, this person invested (in insurance) the sum of $ 66,000.00 and the return of the investment reached $ 602,894.00, more than half a million in difference. Let's say after 20 years Mom decides to terminate and cash out the policy, and transfer the cash value that accumulated on her policy to her child, who is now 25 years old. At this point, she can pass $ 55,856.00 to him tax free. For 20 years the mother paid $ 24,000.00, and the return on her investment was $ 55,856.00 plus "free" life insurance coverage during all this time. If the family, for example, can afford to pay $ 200 a month, then return by the age of 85 equals $1,355,155.00 - tax-free. - No problem. Let’s take a family where a woman is in good health and is 30 years old and her child is 5 years old. Mom buys a life insurance with an “increasing death benefit" option for $ 100 per month in premium with an initial $ 150,849.00 death benefit. In 10 years, the death benefit amount rises to $ 161,454.00 with the same $100 a month premium. In 20 years it worth $ 186,00.00. At the age of 85 years (the average life expectancy in the United States), the insurance amount consists of $ 602,894.00 in coverage. This is the amount that will be inherited by her children or grandchildren in the future. For 50 years, this person invested (in insurance) the sum of $ 66,000.00 and the return of the investment reached $ 602,894.00, more than half a million in difference. Let's say after 20 years Mom decides to terminate and cash out the policy, and transfer the cash value that accumulated on her policy to her child, who is now 25 years old. At this point, she can pass $ 55,856.00 to him tax free. For 20 years the mother paid $ 24,000.00, and the return on her investment was $ 55,856.00 plus "free" life insurance coverage during all this time. If the family, for example, can afford to pay $ 200 a month, then return by the age of 85 equals $1,355,155.00 - tax-free.

This is very interesting!

- Yes, life insurance has dozens of interesting options, but one thing remains constant - the younger you are, the more options you have.

Yes, this is worth considering. Let us move to the topic of retirement planning. What can you tell us about it?

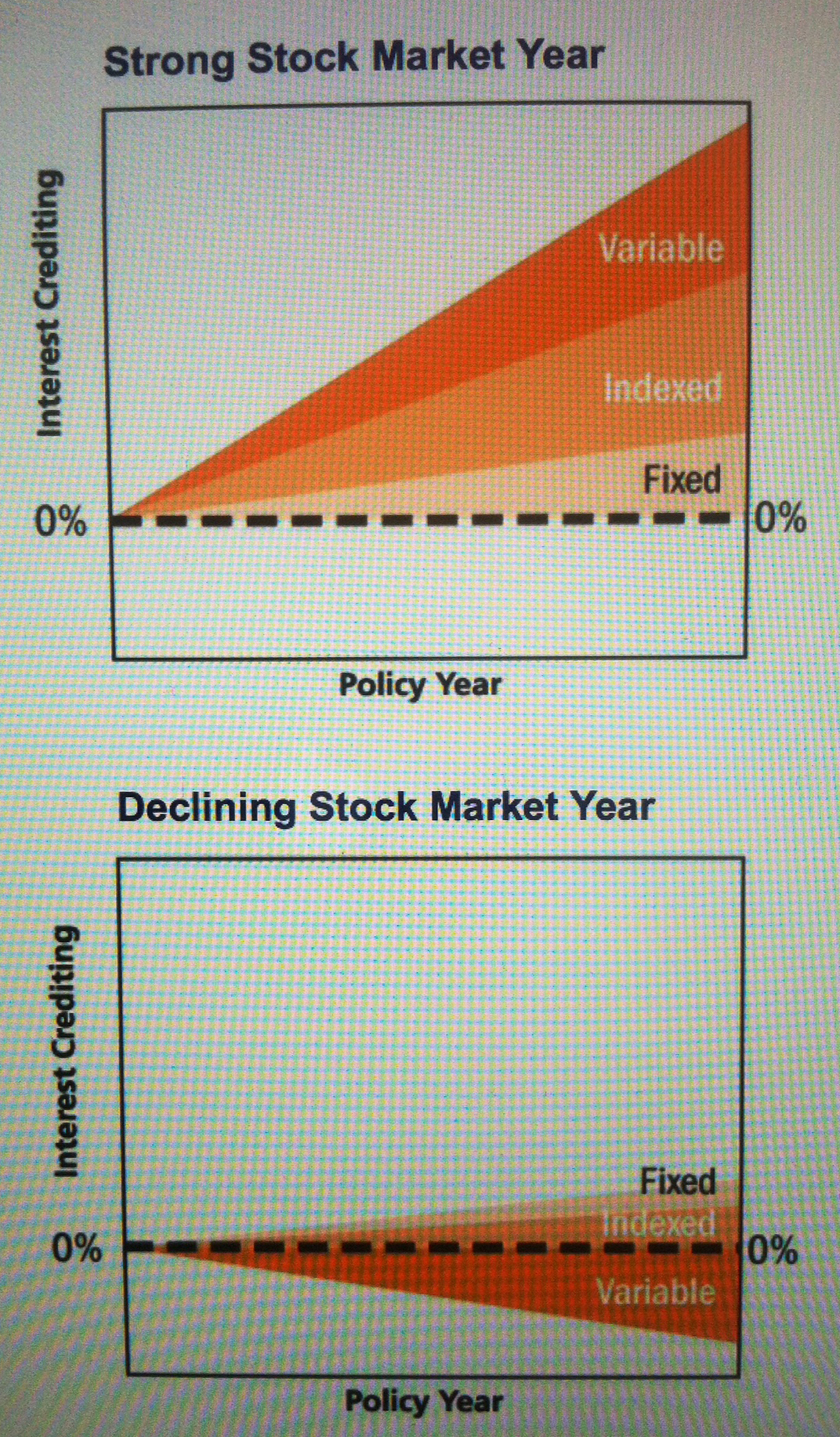

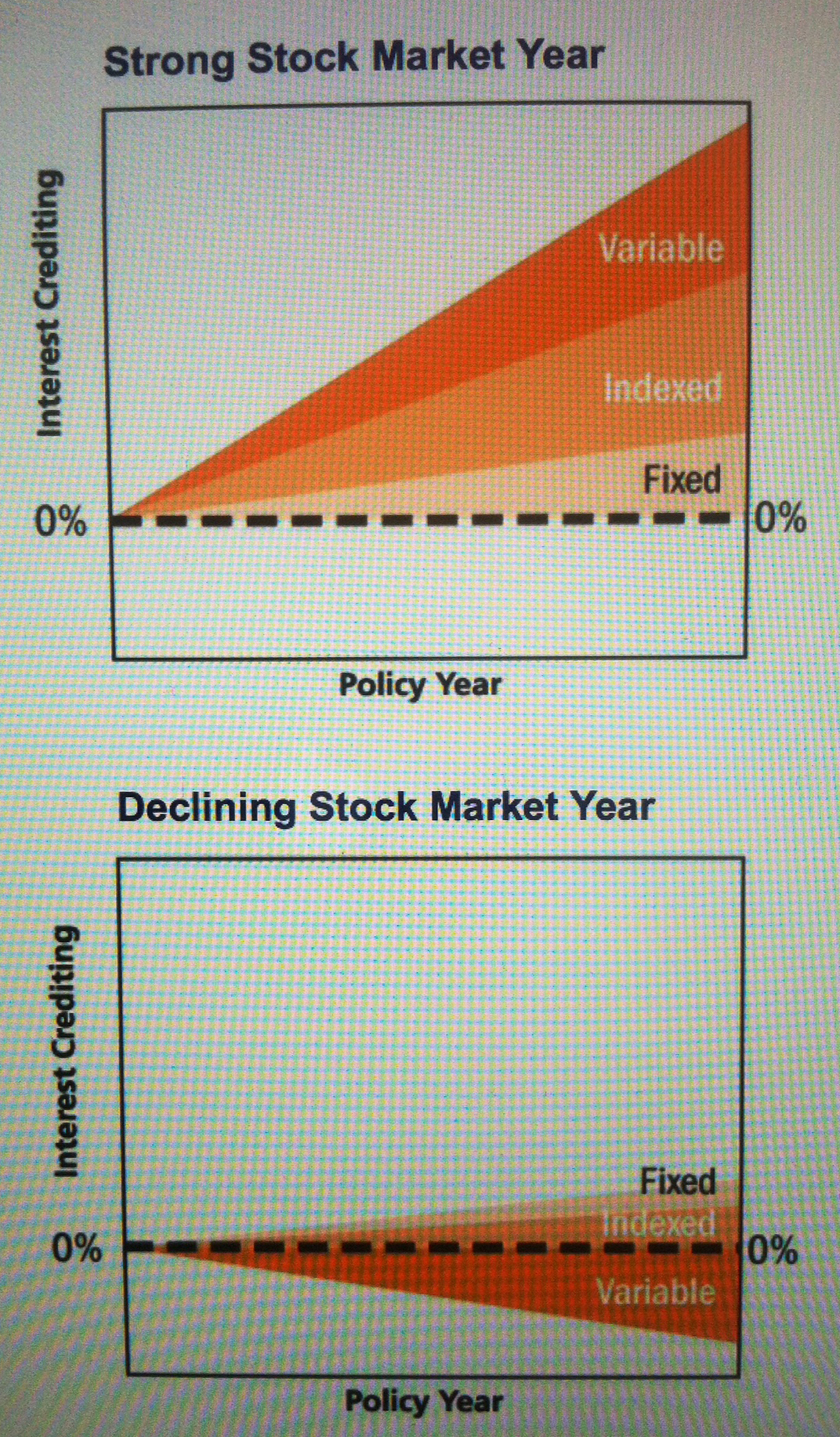

- This is a difficult topic for conversation and cannot be expressed in a few sentences. Let me explain it in simple terms. There are two most common types of investments that people use thorough their lifetime – aggressive (investing in the market) and conservative (keeping money in a bank (CD, Checking / Saving Accounts)). In the first case, the market may go up or down, you can earn money or you can lose it, just like it was in 2001, 2008 and 2011. In the second case, if you keep your money in the bank, then over time, due to inflation, money loses its purchasing power. - This is a difficult topic for conversation and cannot be expressed in a few sentences. Let me explain it in simple terms. There are two most common types of investments that people use thorough their lifetime – aggressive (investing in the market) and conservative (keeping money in a bank (CD, Checking / Saving Accounts)). In the first case, the market may go up or down, you can earn money or you can lose it, just like it was in 2001, 2008 and 2011. In the second case, if you keep your money in the bank, then over time, due to inflation, money loses its purchasing power.

The main product that I work with is called an Indexed Annuity, which is right in between aggressive and conservative investing. An Annuity ensures that your principal can not be lost when the market takes a down turn, and at the same time your money grows by an average of 50% of market growth (measured by the S&P 500). For people over 65 years old it is the most ideal and safest way to invest. One option within an Annuity is to create an indefinite paycheck the policy holder will receive for life, even if the principal is gone. You may sign up for an individual free consultation and I will find an option for you depending on your situation and goals.

Now, just a few words about Long Term Care please.

- Well, Long term Care provides a range of services designed for people with functional limitations or chronic health conditions and can be offered in variety of settings: at home, in nursing homes, etc. It is the biggest depletor of the money that you accumulated during your life time.

When Long Term is needed?

- It is needed when people are cognitively impaired or when they require assistance with activities of daily living such as dressing, eating, continence, toileting, bathing and transferring. Research shows that about 70% of people will need some type of long-term care after age 65 because of longevity and medical advancement.

Why has long-term care become a bigger concern today?

- I can only mention a few: family transformation, asset protection, having health choices and being independent; the list goes on. The cost of health care goes up as we speak.

Can you tell us how much does it cost?

- The cost for these services is devastating and it keeps going up. For example, the cost for a nursing home can exceed over $100,000 a year; in assisted living - over $40,000 and in the home setting - over $46,000 a year. It is expected that the cost will double in the next 15 or 20 years. - The cost for these services is devastating and it keeps going up. For example, the cost for a nursing home can exceed over $100,000 a year; in assisted living - over $40,000 and in the home setting - over $46,000 a year. It is expected that the cost will double in the next 15 or 20 years.

So what options do people have?

- There are three options that people have:

* To be self-insured (where the things they have worked their entire life for could be at risk)

* To have Medicaid (when they have to relinquish most of their assets)

* To have a private insurance (where a monthly premium can be budgeted for and a policy can be tailored according to their specific needs). That’s where I come to play.

Ernest, thank you very much from our readers and from me personally. Would you like to add anything else?

- I would like to add only one thing - take care of yourself and your loved ones!

Ernest Badalov, agent/consultant

Address

Montgomery Village MD, 20886

Phone: 443-527-8975 Russian, English

E-Mail: myretirementcare@gmail.com

http://www.russiandc.com/yp.php?id=496

© Exclusive interview to Ernest Badalov specially for readers of www.RussianDC.com

|

Главная

Главная

О нас

О нас

Реклама

Реклама

Желтые страницы

Желтые страницы

Объявления

Объявления

Календарь событий

Календарь событий

Фотографии

Фотографии

В социальных сетях

В социальных сетях

DC для туристов

DC для туристов

- Medicare is a national social insurance program that guarantees access to health insurance for Americans aged 65 and older who have worked and paid into the system, and younger people with disabilities as well as people with end stage renal disease and persons with amyotrophic lateral sclerosis.

- Medicare is a national social insurance program that guarantees access to health insurance for Americans aged 65 and older who have worked and paid into the system, and younger people with disabilities as well as people with end stage renal disease and persons with amyotrophic lateral sclerosis. - I am licensed in Maryland, Virginia and the District of Columbia (MD, VA, DC).

- I am licensed in Maryland, Virginia and the District of Columbia (MD, VA, DC).  - No problem. Let’s take a family where a woman is in good health and is 30 years old and her child is 5 years old. Mom buys a life insurance with an “increasing death benefit" option for $ 100 per month in premium with an initial $ 150,849.00 death benefit. In 10 years, the death benefit amount rises to $ 161,454.00 with the same $100 a month premium. In 20 years it worth $ 186,00.00. At the age of 85 years (the average life expectancy in the United States), the insurance amount consists of $ 602,894.00 in coverage. This is the amount that will be inherited by her children or grandchildren in the future. For 50 years, this person invested (in insurance) the sum of $ 66,000.00 and the return of the investment reached $ 602,894.00, more than half a million in difference. Let's say after 20 years Mom decides to terminate and cash out the policy, and transfer the cash value that accumulated on her policy to her child, who is now 25 years old. At this point, she can pass $ 55,856.00 to him tax free. For 20 years the mother paid $ 24,000.00, and the return on her investment was $ 55,856.00 plus "free" life insurance coverage during all this time. If the family, for example, can afford to pay $ 200 a month, then return by the age of 85 equals $1,355,155.00 - tax-free.

- No problem. Let’s take a family where a woman is in good health and is 30 years old and her child is 5 years old. Mom buys a life insurance with an “increasing death benefit" option for $ 100 per month in premium with an initial $ 150,849.00 death benefit. In 10 years, the death benefit amount rises to $ 161,454.00 with the same $100 a month premium. In 20 years it worth $ 186,00.00. At the age of 85 years (the average life expectancy in the United States), the insurance amount consists of $ 602,894.00 in coverage. This is the amount that will be inherited by her children or grandchildren in the future. For 50 years, this person invested (in insurance) the sum of $ 66,000.00 and the return of the investment reached $ 602,894.00, more than half a million in difference. Let's say after 20 years Mom decides to terminate and cash out the policy, and transfer the cash value that accumulated on her policy to her child, who is now 25 years old. At this point, she can pass $ 55,856.00 to him tax free. For 20 years the mother paid $ 24,000.00, and the return on her investment was $ 55,856.00 plus "free" life insurance coverage during all this time. If the family, for example, can afford to pay $ 200 a month, then return by the age of 85 equals $1,355,155.00 - tax-free.  - This is a difficult topic for conversation and cannot be expressed in a few sentences. Let me explain it in simple terms. There are two most common types of investments that people use thorough their lifetime – aggressive (investing in the market) and conservative (keeping money in a bank (CD, Checking / Saving Accounts)). In the first case, the market may go up or down, you can earn money or you can lose it, just like it was in 2001, 2008 and 2011. In the second case, if you keep your money in the bank, then over time, due to inflation, money loses its purchasing power.

- This is a difficult topic for conversation and cannot be expressed in a few sentences. Let me explain it in simple terms. There are two most common types of investments that people use thorough their lifetime – aggressive (investing in the market) and conservative (keeping money in a bank (CD, Checking / Saving Accounts)). In the first case, the market may go up or down, you can earn money or you can lose it, just like it was in 2001, 2008 and 2011. In the second case, if you keep your money in the bank, then over time, due to inflation, money loses its purchasing power.  - The cost for these services is devastating and it keeps going up. For example, the cost for a nursing home can exceed over $100,000 a year; in assisted living - over $40,000 and in the home setting - over $46,000 a year. It is expected that the cost will double in the next 15 or 20 years.

- The cost for these services is devastating and it keeps going up. For example, the cost for a nursing home can exceed over $100,000 a year; in assisted living - over $40,000 and in the home setting - over $46,000 a year. It is expected that the cost will double in the next 15 or 20 years.